tax credit survey mean

A WOTC tax credit survey includes WOTC screening questions. A company may choose to conduct their.

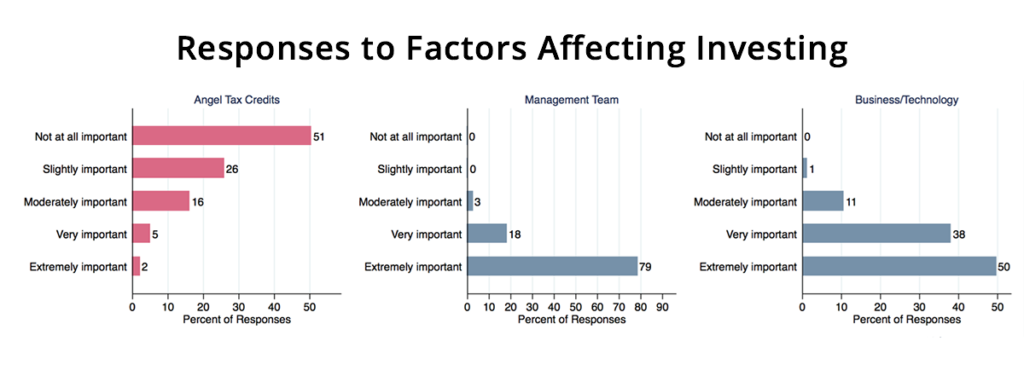

State Tax Credits For Angel Investors Backfire Ucla Anderson Review

I dont just give anyone my SSN unless I am hired for a job or for credit.

. It asks for your SSN and if you are under 40. If so you will need to complete the questionnaire when you apply to a position or. Survey_mean should always be called from summarise.

A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. I also thought that asking for a persons age was. Our company participates in a federal employment initiative called the Work Opportunity Tax Credit WOTC.

Examples include the federal Hiring Incentive to Restore. We request that you complete the following survey to determine if our. Becaue the questions asked on that survey are very private and.

A wrapper around svymean or if proportion TRUE svyciprop. They can be accessed by hiring veterans or individuals from targeted in need groups or by setting up shop in. A tax credit survey is simply a.

Big companies want the tax credit and it might be a determining factor in selecting one applicant over another. Pre-Hire During the Application Process If you apply to a. Governments often enact tax incentives for businesses to hire workers.

You can possibly claim a credit equally to 26 percent of an employees pay if they work 400 hours or more during the tax year. What Is a Tax Credit Survey. Tax credit surveys can be performed by the company itself or by an independent company specializing in this task.

Tax credit survey when applying a job is to credited the tax before the gross income of the pay check. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Tax credits can range from 1000 to almost 40000.

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe. Tax credits are more favorable than tax deductions. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have. You can possibly claim a credit equally to 26. The Work Opportunity Tax Credit WOTC is a Federal tax credit incentive that Congress provides to employers for hiring individuals from certain target groups who have.

A tax credit survey is simply a questionnaire designed to identify job applicants covered by a tax incentive. Calculate means and proportions from complex survey data.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Earned Income Tax Credit Wikipedia

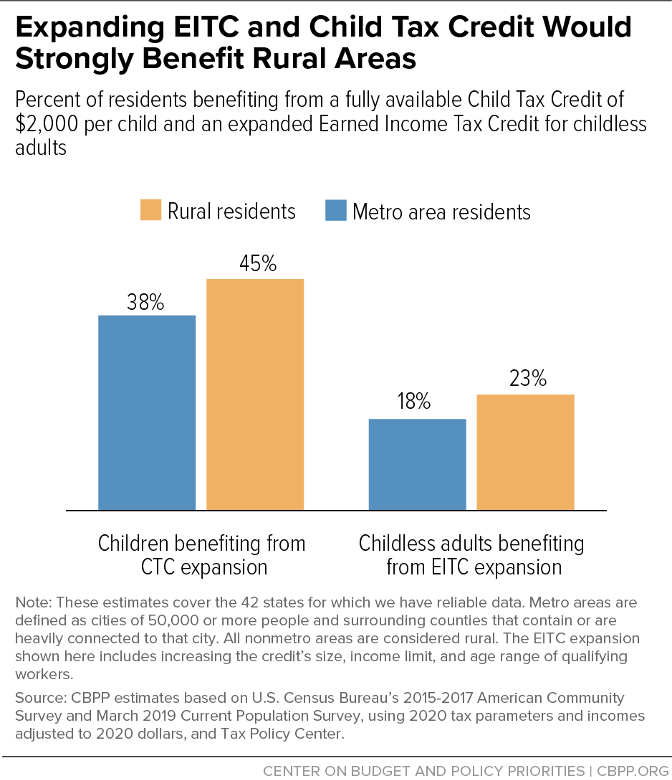

Expanding Child Tax Credit And Earned Income Tax Credit Would Benefit More Than 10 Million Rural Residents Strongly Help Rural Areas Center On Budget And Policy Priorities

Fillable Online Tax Credit Questionnaire Fax Email Print Pdffiller

Work Opportunity Tax Credit R D Other Incentives Adp

Retrotax Tax Credit Administration Jazzhr Marketplace

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

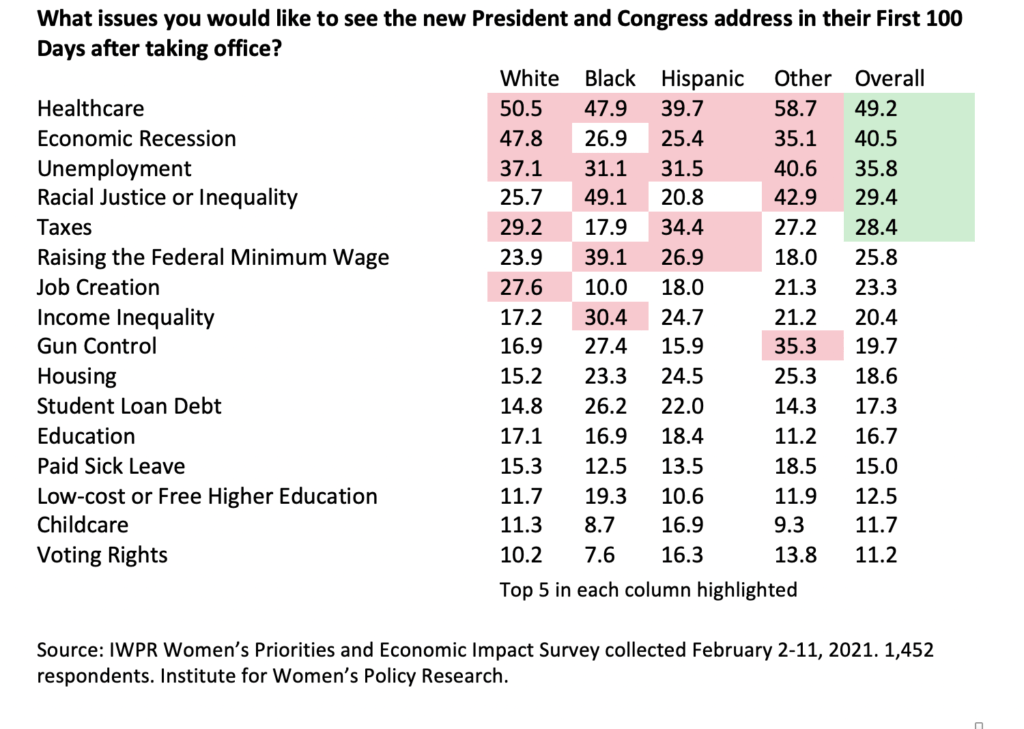

Women To Biden Administration And Congress Affordable Healthcare The Economic Recession And Jobs Are Top Priorities New National Survey Finds Iwpr

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit 2022 Survey Families Struggle Afford Basic Goods After Expiration

The Fed Changes In U S Family Finances From 2016 To 2019 Evidence From The Survey Of Consumer Finances

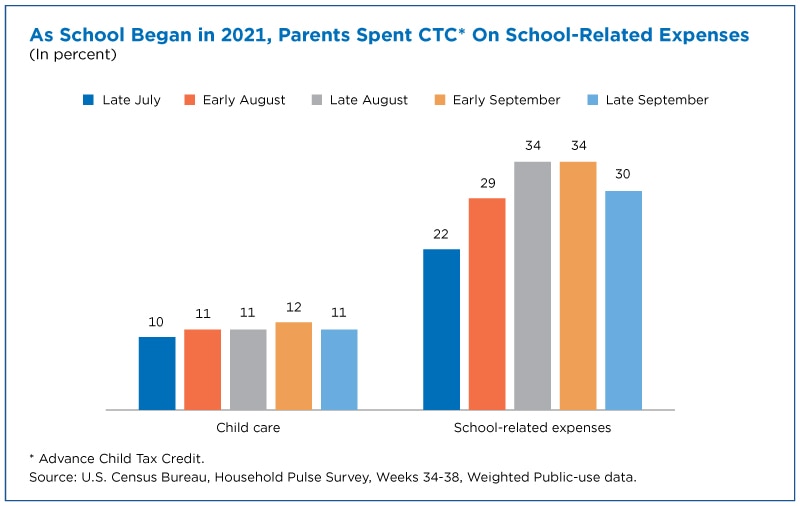

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Face It You Probably Got A Tax Cut The New York Times

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

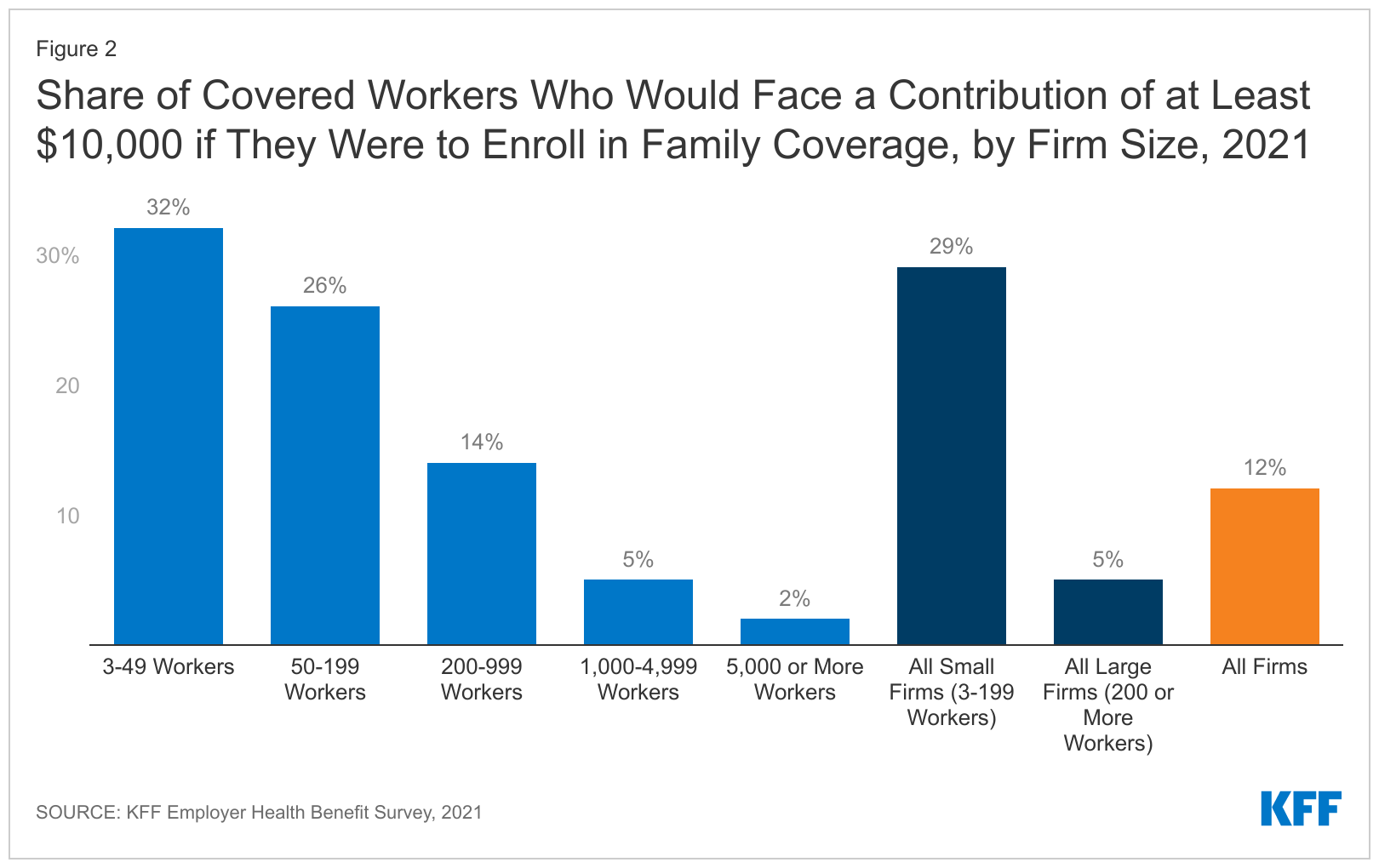

Many Workers Particularly At Small Firms Face High Premiums To Enroll In Family Coverage Leaving Many In The Family Glitch Kff