nebraska vehicle tax calculator

Nebraska vehicle tax calculator. Average Local State Sales Tax.

Vehicle Registration Nebraska Department Of Motor Vehicles

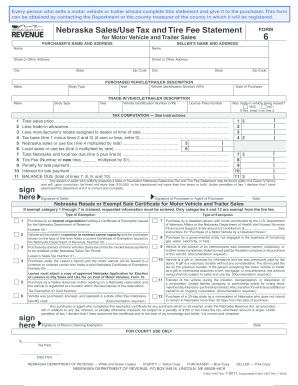

How to Calculate Nebraska Sales Tax on a Car.

. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. Subsequent brackets increase the tax 10 to.

View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator. Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above. Nebraska Documentation Fees.

Send the renewal notice a copy of your. There are four tax brackets in. For example lets say that you want.

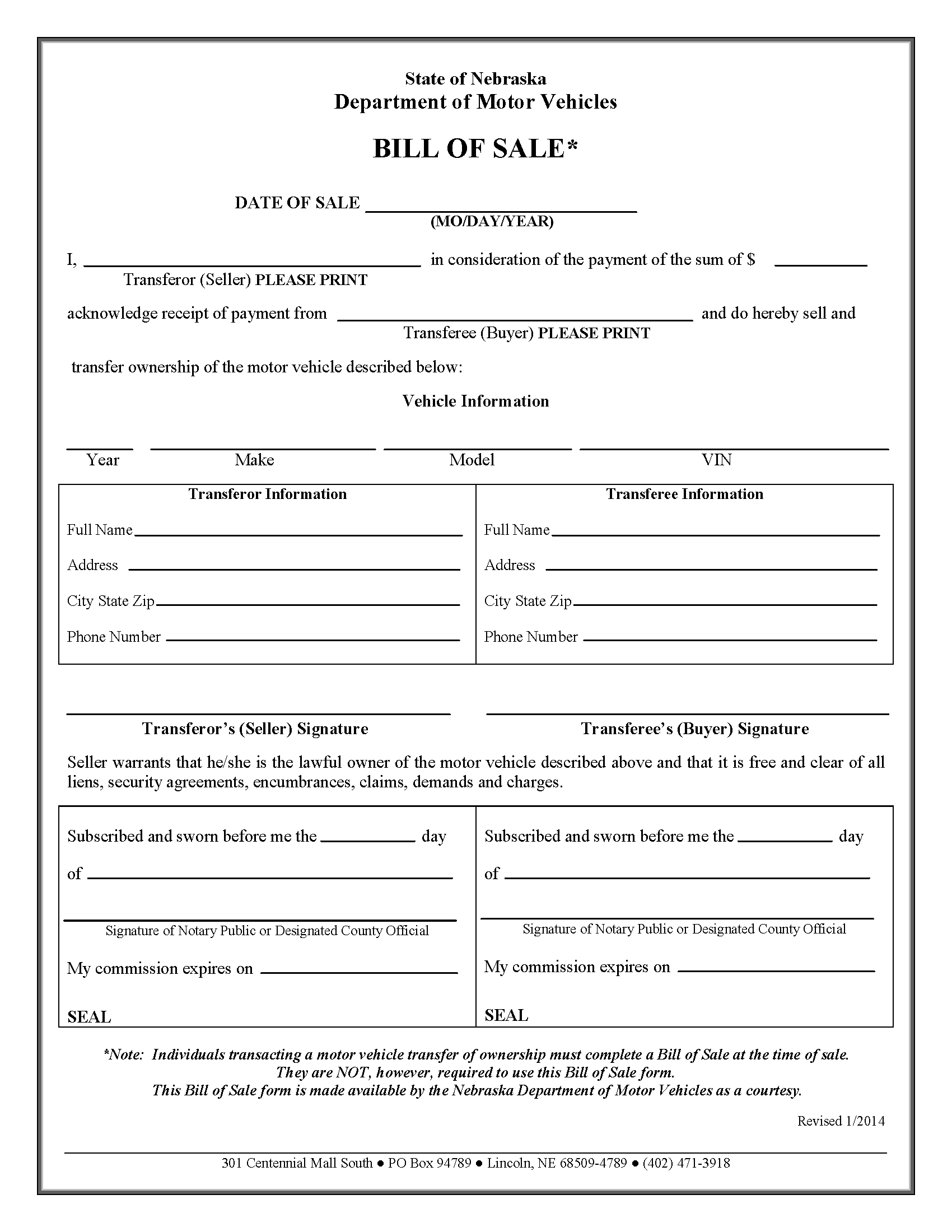

Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Vehicle tax or sales tax is based on the vehicles net purchase price.

The net price of 38250 equals the. 1st Street Papillion NE 68046. Maximum Local Sales Tax.

17007 Burt Street in Omaha 4606 North 56th Street in Omaha no written or drive tests 4502 Maass Road in Bellevue and 500 West O Street. Nebraska State Sales Tax. Vehicle Tax Costs.

This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. All data based on your calculation. The nebraska state sales and use tax rate is 55.

Its fairly simple to calculate provided you know your regions sales tax. Once the msrp of the vehicle is established a base tax set in nebraska motor vehicle. 425 motor vehicle document fee.

Nebraskas state income tax system is similar to the federal system. In Nebraska the sales tax percentage is 55 meaning. If you dont want to create a TxT account you can still use this online option to renew.

Maximum Possible Sales Tax. If you are registering a motorboat. The average effective property tax rate in nebraska is 161 which ranks among the 10 most burdensome states in the country when it comes to real estate taxes.

Vehicle Information required Motor Vehicle Tax calculations are based on the MSRP Manufacturers Suggested Retail Price of the vehicle. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Nebraska Income Tax Calculator 2021.

If you are unsure. The calculator will show you the total sales tax amount as well as the county city. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680.

Its a progressive system which means that taxpayers who earn more pay higher taxes. Your average tax rate is 1198 and your marginal. Complete the Vehicle Registration Renewal application.

This is less than 1 of the value of the motor vehicle.

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

Vehicle Registrations Nebraska Department Of Motor Vehicles

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Nebraska Auto Taxes And Fees To Watch Out For Woodhouse Nissan

How To Do A Nebraska Dmv Change Of Address Moving Com

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

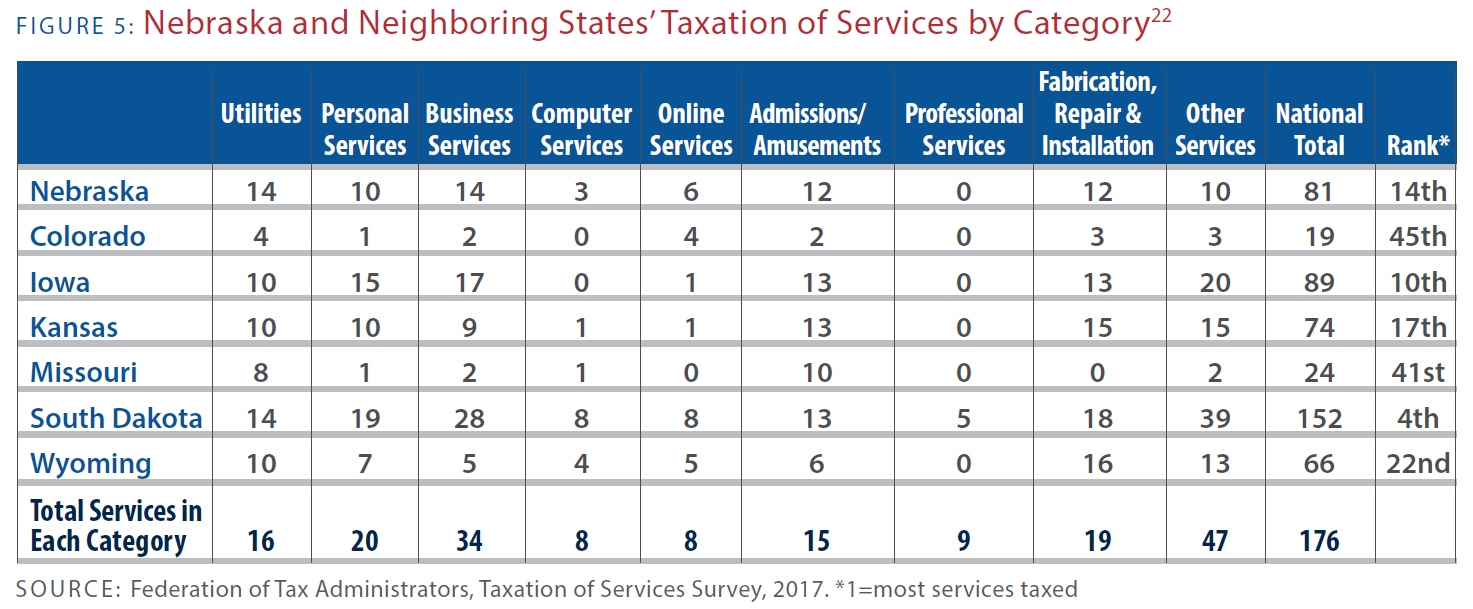

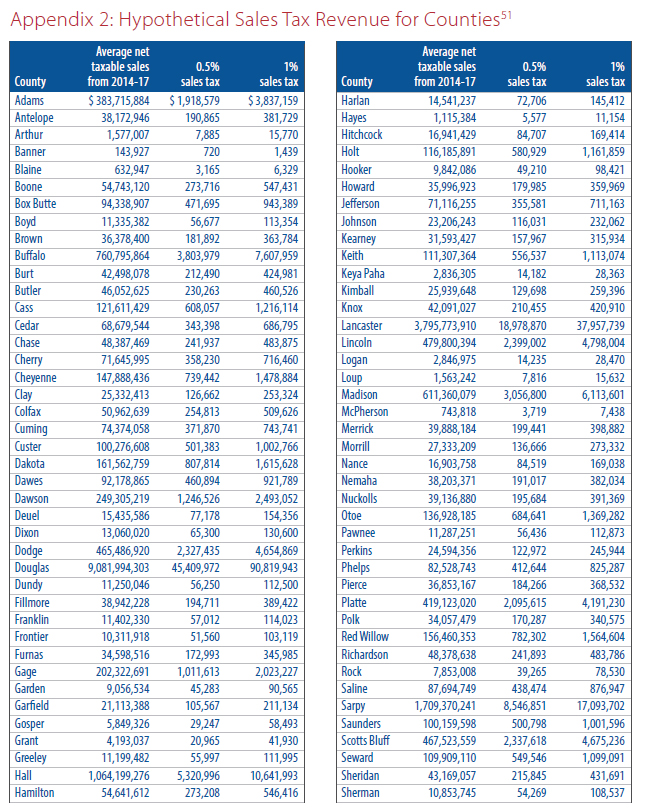

Taxes And Spending In Nebraska

Car Tax By State Usa Manual Car Sales Tax Calculator

Taxes And Spending In Nebraska

1040ez Tax Calculator Nebraska Energy Federal Credit Union

Dmv Fees By State Usa Manual Car Registration Calculator

Nebraska Launches Online Property Tax Credit Calculator

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Online Vehicle Tax And Tags Calculators Dmv Org

Car Tax By State Usa Manual Car Sales Tax Calculator